American Residents living abroad can also use the electronic site links to at least pay their tax bills by April 15th of this year (see more for American residents living abroad below). Put the year of the taxes & 1040 on the memo line. If paying by mail, most of the vouchers have instructions as to how to pay them, but if you're paying the IRS, do NOT make the payment to the "IRS," but rather to the "United States Treasury", fully written out. Ogden - Internal Revenue Submission Processing Center Kansas City - Internal Revenue Submission Processing Center Austin - Internal Revenue Submission Processing CenterĬincinnati - Internal Revenue Submission Processing Centerįresno - Internal Revenue Submission Processing Center They are pasted here for you below as well.

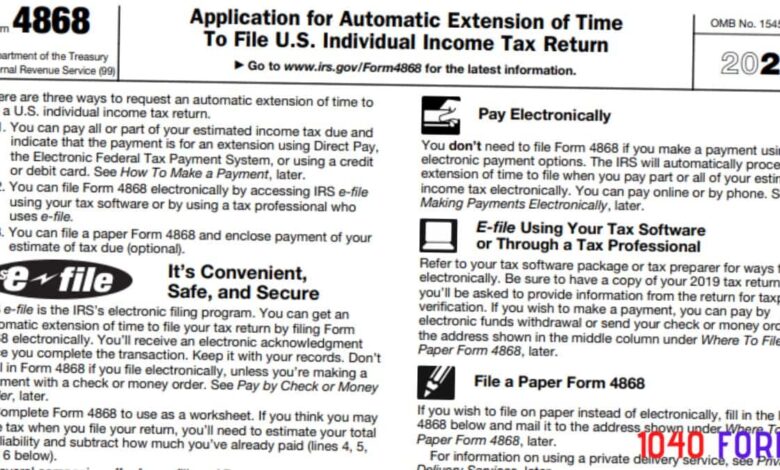

If you are using FedEx, DHL, or UPS to overnight your payment and voucher, send it to the addresses mentioned on this IRS page. It is a street address, so you can use a private courier. The third page of the 2350, has the IRS Austin address of where to send your mailing to. The second page of the IRS 4868 extension voucher has DIFFERENT addresses for the IRS to mail your voucher to, depending on where you live. If you owe, you can either mail the federal IRS 4868 voucher (or 2350, if you're living abroad) with that payment or use one of the following links below to make an electronic payment. If there is a refund, nothing to worry about as you do not have to take an extension (see second & third bullet points of this link). In order to calculatte your federal income taxes, in case you can't file by April 15th, 2014, just download the above spreadsheet, fill in all the fields in blue, and see if the sheet calculates a federal income "tax due" for you at the bottom of the excel sheet. (You still have to calculate your own personal state income taxes, for which we've provided a simple formula here for you to do at the bottom of this page). This year you do not have to worry about calculating your federal income taxes on your own. The following is only for personal income tax extensions. Read the first two paragraphs below, then select your voucher.

0 kommentar(er)

0 kommentar(er)